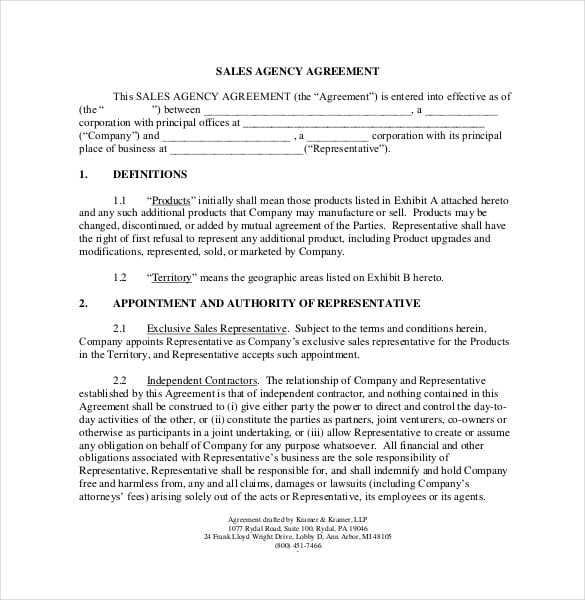

Commission Sales Agreement Form

We see it all the time—especially among companies with small sales teams: sloppy sales commission agreements. Unfortunately, we’re also seeing more and more cases where companies get burned by vague or poorly-written sales compensation plan documents.

A recent sales commission lawsuit filed under the Massachusetts Wage Act confirmed that while the administration of sales commission plans is discretionary (you can create any provisions you want), the commissions themselves are not (you have to honor whatever agreements you have in place). In the end, a pretty big company lost this case. And they’re not alone.

In states like Massachusetts and Maryland, wage payment and collection laws may entitle sales reps to recover up to three times the amount of any unpaid sales commission, in addition to attorney fees. More often than not, courts side with employees.

This Sales Consultant Agreement or Commission Sales Agreement sets out the terms by which an independent sales consultant agrees to sell products or services on behalf of a company. A lawyer can customize this free template for your needs, including how you want to structure commission and compensation. Our commission agreement templates are ideal for this purpose. Available in Word, Excel and PDF formats, these templates allow the user to fill in percentage of commission payable, name of the sales executive, details of the company the sales executive has signed up with, other terms and conditions and important data. As public records, contract forms adopted by the Texas Real Estate Commission are available to any person. Real estate license holders are required to use these forms. However, TREC contract forms are intended for use primarily by licensed real estate brokers or sales agents who are trained in their correct use. Mistakes in the use of a form.

Do you know your state’s policy on earned wages, commissions, and bonuses? Are you aware that policies may be different for employees who work in other states, apart from your corporate headquarters? Most importantly, do you have a formal, legally-reviewed sales commission agreement in place, with signoff from all your employees? If not, the following post offers advice on where to start.

Put Your Sales Commission Agreement in Writing

The idea of a sales commission plan sounds simple enough—until you run into those inevitable gray areas… A sales rep is manipulating discount terms in order to book higher sales figures. Or maybe one of his closed accounts requires a refund. Does your plan include language to address these scenarios?

Writing a comprehensive sales commission agreement should be a top priority for any organization that doesn’t already have one. For all employees, you must provide a written description of rates of pay, manner of pay, and advanced notice of any changes. If there’s any contract ambiguity, a court will often decide in favor of the employee.

You can download sample sales commission plans online, but we highly recommend professional support on two fronts. First, design the right plan—with help from a firm that specializes in sales compensation strategy. Second, work with a legal team that has experience in the state(s) where you do business. All documentation should be reviewed to make sure it’s legally compliant and aligned with your strategic goals.

Define the Terms of Crediting and Payment

Your plan must clearly define a.) when a sale is credited for commissions to be earned, and b.) when those commission will be paid. In terms of sales crediting, common options include:

- When the order is booked

- When it is shipped

- When it is delivered or installed

- When payment is received

If you don’t explicitly outline earning terms, an unhappy sales rep may have grounds for a lawsuit. The default status for commission earnings, as defined by most courts, is usually when the order is booked. Without existing documentation to support your position, courts typically disregard holding commission payments until the customer has received the shipment or made payment.

Be sure you also address crediting terms in your plan. (We think the best commission crediting policy, the one that is most motivating for your sales reps, is to reward reps for the events they can control. So commission should be earned and credited at booking.)

To avoid losing money, document a recovery policy that says commission is payable on a net sale amount, and subject to returns, cancellation and non-payment. Ideally, the recovery policy should apply to future commissions, so employees never have to give money back. This kind of provision also incentivizes sales reps to focus on quality customers (companies with good credit and a solid reputation).

Remember to include any specifics that factor into your commission formulas—for example, do you intend to back out discounts, taxes, or freight costs before establishing the figure on which commission will be calculated?

Define Sales Commission Earnings

Each of your sales reps should clearly understand how you will define commission earnings—especially if you’re using a more motivating commission plan (as opposed to a simple, flat-rate plan). With a ramped or tiered commission plan, different rates may apply at different levels of sales attainment. Your agreement should explain any rate tables used to calculate variable rates, and outline eligibility for any attainment bonuses (e.g. quarterly bonuses or spiffs).

When wage complaints are filed, state departments of labor first look to see how much transparency the employer provided. Having a plan that allows every rep to calculate commissions can protect you from liability. Having a sales commission portal that allows reps to view and calculate prospective commissions on their own is even better, from a transparency standpoint.

Outline Terms of Employee Status Changes

What will happen when an employee…

- Separates from the company?

Sales Commission Agreement Pdf

- Goes on leave?

- Transitions into a new sales role or a non-sales, salaried role?

Are commissions owed based on any sales earned before the status change?

Questions like these are among the most common reasons why sales commission disputes go to court. And if you have a long sales cycle, there’s a good-sized window for status changes to occur between booking and payment. Clearly communicate your status change policies to anyone in your organization who is paid a commission or a bonus.

Update Your Commission Plan Every Year

Sales commission agreements can quickly become outdated. But in a recent sales commission webinar poll, we found 50 percent of participants hadn’t updated their plans in over a year—potentially failing to address evolving job roles, changing employment laws, and other variables.

If you’re overdue, start reviewing your plan today. Partner with compensation plan experts to be sure you’re on the right track. Always have your legal team review any proposed changes. Look for a firm that specializes in employment, corporation, and business law services. You can also watch our webinar, to learn more about avoiding unpaid commissions lawsuits and liability damages.

The wording on any contract is important. Sales commission contracts must be very explicit in their wording to avoid both unnecessary legal and financial obligations. A sales commission contract must outline terms, what constitutes a sale, legal relationship (contract or employee), dates of payment, selling limitations and territory. Failure to word the contract correctly can result in lost revenue and even legal issues. Both the sales person and company must go over the contract prior to it being signed so both parties understand the terms and what they mean clearly.

Define the parties. The first step in any contract is defining who the parties are and what their relationship is. Lect Law gives the following example: 'THIS AGREEMENT by and between, whose address is, hereinafter referred to as 'Company,' and, whose address is, hereinafter referred to as 'Sales Representative.' WHEREAS, Company is engaged in the marketing and sale of and WHEREAS, Sales Representative desires to sell Company's services in accordance with the terms and conditions of this Agreement. NOW, THEREFORE, it is agreed as follows: '

Define the limitations of the sales representative. This includes what they can and cannot say about their products. Define what their territory is and in what scope they can act as a sales person. For example, are they allowed to recruit other sales people?

Protect the company legally by defining the salesperson as an independent contractor. An independent contractor is not an employee and does not have benefits. The company does not withhold tax or provide any frills unless specified. Public Legal Forms defines an independent contractor as: 'INDEPENDENT CONTRACTOR: This Agreement shall not render the Agent an employee, partner or joint venturer with the Company for any purpose. The Agent is and will remain an independent contractor in his or her relationship to the Company. The Company shall not be responsible for withholding taxes with respect to the Agent's compensation hereunder. The Agent shall have no claim against the Company hereunder or otherwise for vacation pay, sick leave, retirement benefits, Social Security, worker's compensation, health or disability benefits, unemployment insurance benefits or employee benefits of any kind.'

Define the duties of the independent contractor. Explicitly state what the sales person is responsible for. Attach quantifiable performance measurement items to the duties. If it is not defined, then the sales person does not have to do it. Even something as simple as being polite to customer must be defined. For example: 'The sales representative will conduct themselves in a professional manner and always represent the best interests of company XYZ. The sales representative is responsible for contacting 10 new perspective clients a day and generating at least 3 sales demonstrations a week.'

Define compensation. Compensation for sales people is usually defined as a percentage of goods sold based on either profits or revenue (this must be defined). Payment terms must also be defined. Is the payment for commissions paid when the client pays, is it paid bi-weekly or monthly? For example, 'The sales person will be paid 20 percent of all revenue they earn for the company, after the client pays, on the first of each month.'

Define the term or length of the contract. This can also include a renewal clause. Public Legal Forms gives this example: 'TERM: Unless renewed, this Agreement expires at midnight on *****___* [date]. RENEWAL:Not applicable or This Agreement shall automatically renew for increments ofdays or_ one month or _ one year, unless either party gives__ days written notice to the other party of his or her intent not to renew.'

Sign and date the contract. Have a witness present to confirm the authenticity of the contract.

- firma contract 20309 image by pablo from Fotolia.com